January 17, 2024

Understanding the Windfall Tax in India: Recent Changes

Introduction:

• India has recently made adjustments to its windfall tax on petroleum crude, reducing it to 1,700 rupees ($20.53) per tonne from the previous rate of 2,300 rupees per tonne, as outlined in a recent government notification.

What is the Windfall Tax?

• The concept of the windfall tax involves governments imposing levies on certain industries that experience significantly higher-than-average profits due to favorable economic conditions. The term “windfall” signifies an unexpected surge in profits, and the associated tax is aptly termed the windfall tax.

Imposition and Conditions:

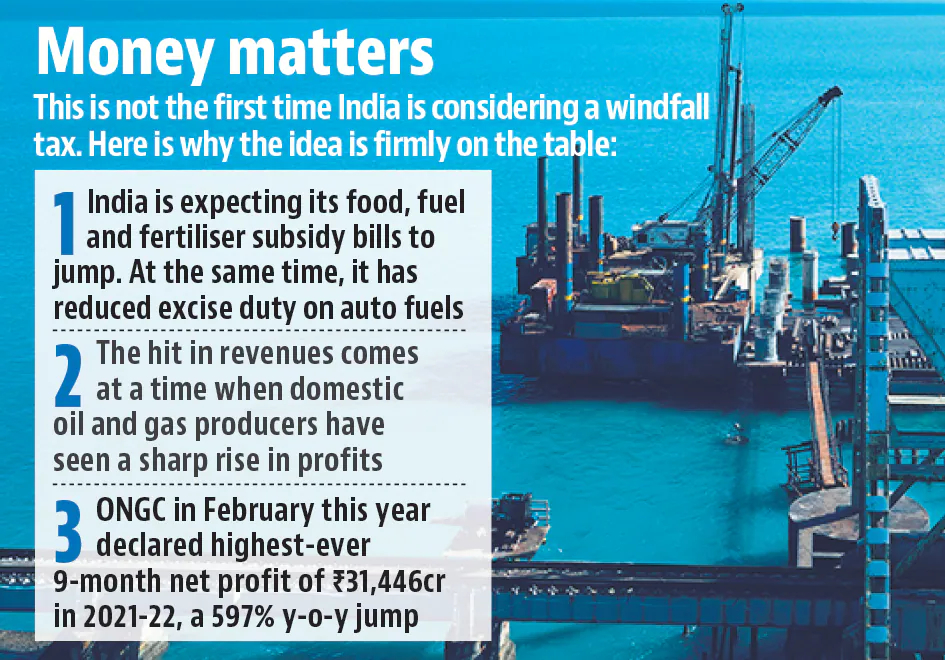

• Governments typically impose the windfall tax when they observe a sudden and substantial increase in revenue within a specific industry. Crucially, these windfall gains should not be attributed to the company’s deliberate actions, such as strategic initiatives or expansions. Instead, the tax is triggered by a one-off external event for which the business is not accountable.

Recent Example and Applicability:

• A recent illustration of the windfall tax is the sharp rise in profits witnessed by the oil and gas industries due to the Russia-Ukraine conflict. The government taxes these unexpected windfalls over and above the regular tax rates. Industries commonly targeted for windfall gains tax include oil, gas, and mining.

Purpose of the Windfall Tax:

• Redistribution: It serves to redistribute unexpected gains, ensuring that high prices benefiting producers do not come at the expense of consumers.

• Social Welfare Funding: The tax is utilized to fund social welfare schemes, contributing to the overall welfare of the populace.

• Supplementary Revenue: Acting as a supplementary revenue stream for the government, the windfall tax assists in financial stability.

• Trade Deficit Management: It becomes a tool for the government to narrow the country’s widening trade deficit.

Conclusion:

• The recent adjustment in India’s windfall tax on petroleum crude reflects an ongoing effort to strike a balance in taxing industries that experience unforeseen profit surges. Understanding the purpose and conditions surrounding the windfall tax is crucial for comprehending its role in economic governance.

January 30, 2025

January 20, 2025

January 14, 2025