January 12, 2024

Understanding Momentum Investing for Enhanced Returns

Introduction:

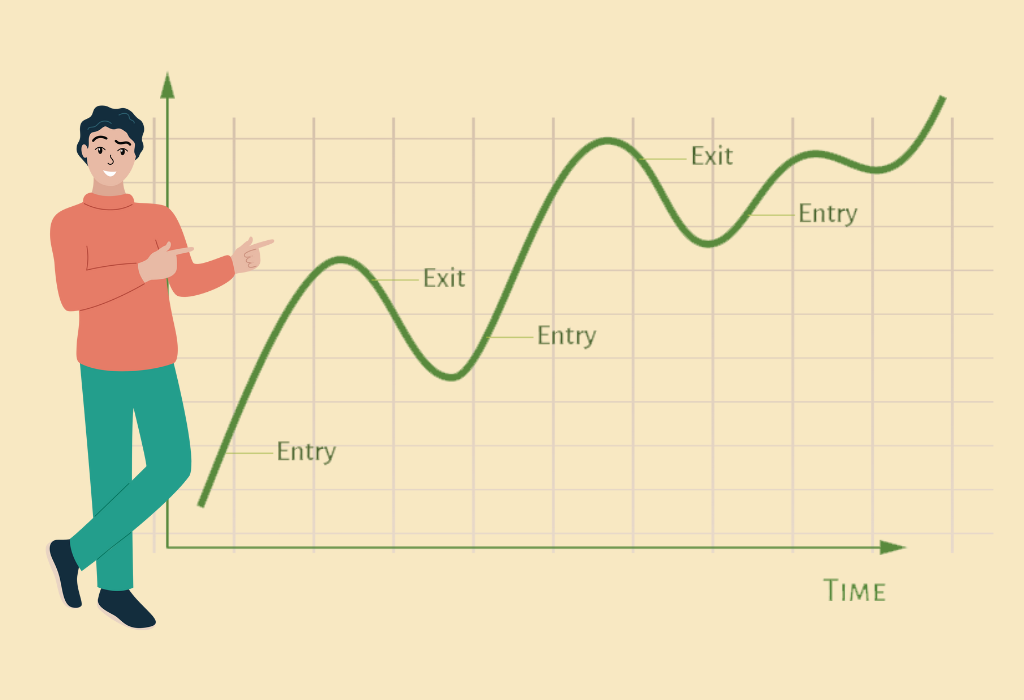

- Momentum investing is a distinctive approach wherein investors strategically engage with assets, such as stocks or bonds, exhibiting consistent upward price movements, while divesting those experiencing price declines. Unlike traditional investment wisdom, momentum investors operate on the principle of “buy high, sell higher,” aiming to capitalize on existing price trends rather than seeking undervalued assets.

Key Concepts of Momentum Investing:

Definition and Strategy:

- Momentum investing involves purchasing assets with a history of rising prices, anticipating the continuation of this upward momentum. Simultaneously, assets with declining prices are sold under the assumption that the negative trend will persist.

Basis of Operation:

- The philosophy underlying momentum investing posits that discernible trends exist in asset prices, and these trends exhibit persistence over time. Investors capitalize on the predictability of these trends, identifying opportunities early on to secure substantial profits.

Limited Emphasis on Fundamental Analysis:

- Unlike traditional investment approaches, momentum investors typically forego deep fundamental analysis. Their decisions are primarily driven by the observable price trends, indicating a departure from assessing the intrinsic value of assets.

Risk and Reward:

- Momentum investing entails a calculated acceptance of risk. Investors actively seek assets with strong, established trends, aiming to ride the momentum for increased returns. Conversely, they swiftly divest assets showing signs of decline, mitigating potential losses.

Conclusion:

- In conclusion, momentum investing represents a departure from conventional strategies, relying on the observable trends in asset prices. The “buy high, sell higher” philosophy challenges the traditional wisdom of “buy low, sell high,” offering investors a unique avenue for potentially higher returns. Understanding and navigating these momentum-driven strategies can provide investors with a distinct edge in the dynamic landscape of financial markets.

Gist of daily Article /The Hindu 17oct 2025

October 17, 2025

Daily Gist of the Hindu/Indian Express : 16 Oct 2025

October 16, 2025

Daily Gist of The Hindu/Indian Express: 6 Oct 2025

October 6, 2025

Daily Gist of Article /The Hindu /Indian Express: 24 Sep 2025

September 24, 2025