February 20, 2024

Understanding Disinflation: Implications and Causes

Introduction:

- Recently, the governor of the Reserve Bank of India (RBI) highlighted the challenges posed by recurring food price shocks and geopolitical tensions to the ongoing process of disinflation. It’s essential to comprehend what disinflation entails, its implications, and the factors contributing to its occurrence.

Disinflation Defined:

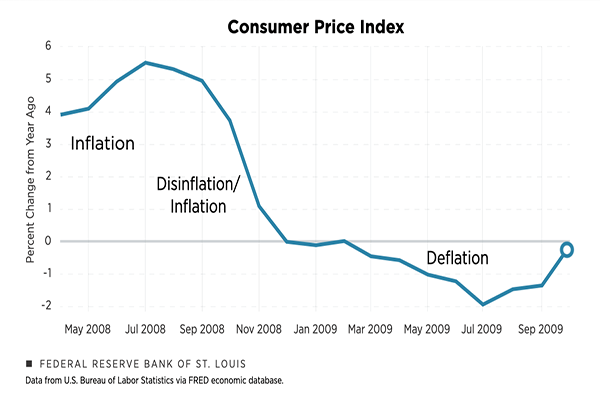

- Disinflation denotes a decrease in inflation rates, indicating a slowdown in the rate of increase in the general price level of goods and services within a country’s GDP over time. Unlike inflation and deflation, which denote price directions, disinflation refers specifically to the rate of change in inflation. Importantly, disinflation does not entail actual price decreases, and it typically does not signify a contracting economy. Instead, it represents a controlled economic contraction, preventing the economy from overheating, thus holding significance for economic stability.

Implications of Disinflation:

- A controlled level of disinflation is imperative as it signifies a healthy economic adjustment, mitigating the risk of overheating within the economy. Unlike deflation, which can lead to a downward spiral of falling demand and economic stagnation, disinflation allows for a moderation in price growth without inducing negative economic consequences. Moreover, disinflation stands in contrast to reflationary measures, where governments stimulate economic activity by injecting additional liquidity into the market, highlighting its role in maintaining economic equilibrium.

Causes of Disinflation:

- Disinflation can stem from various factors, including monetary policy adjustments and changes in market dynamics. For instance, if a central bank implements a tighter monetary policy, restricting the money supply, it can induce disinflationary pressures. Similarly, during periods of economic recession, businesses may refrain from raising prices to sustain market competitiveness, contributing to disinflation. Additionally, external factors such as geopolitical tensions and supply chain disruptions can exacerbate disinflationary trends, further complicating the economic landscape.

Conclusion:

- In essence, disinflation represents a crucial aspect of economic management, facilitating sustainable growth while averting the risks associated with inflationary pressures. Understanding the implications and causes of disinflation is paramount for policymakers and market participants alike, as they navigate the complexities of macroeconomic stability in an ever-evolving global landscape.

Daily Gist : The Hindu/Indian Express : 30 Jan 2025

January 30, 2025

Gist of editorial : the Hindu/ Indian Express/20 Jan 2025

January 20, 2025

Daily the Hindu/ Indian Express Editorial Gist: 14 Jan 2025

January 14, 2025