December 29, 2023

Understanding the Foreign Exchange Management Act (FEMA) in India

Introduction:

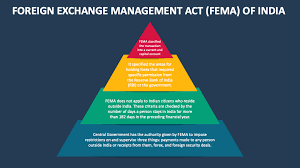

- The Foreign Exchange Management Act (FEMA) of 1999 emerged as a pivotal successor to the former Foreign Exchange Regulation Act (FERA) of 1973, marking a transition in India’s economic landscape following liberalization. Its inception aimed to adapt to evolving economic conditions, facilitating external trade, fostering the foreign exchange market’s orderly growth, and streamlining transactional procedures.

Overview of FEMA:

- FEMA’s primary objective revolves around easing external trade and payment facilitation while ensuring the structured development of India’s foreign exchange market. The act encompasses regulations governing formalities, procedures, and engagements pertaining to foreign exchange transactions within the country. It encapsulates a broad spectrum, regulating acquisition, retention, payment, and settlement of foreign exchange, alongside currency import-export activities and related dealings. Notably, the Reserve Bank of India (RBI) wields the authority to frame regulations and rules in alignment with FEMA’s provisions. Violations of FEMA can culminate in penalties and fines, administered by its enforcement arm, the Enforcement Directorate headquartered in Delhi.

Scope and Applicability:

- FEMA holds jurisdiction over the entirety of India and extends its reach to agencies and offices, domestically and internationally, managed or owned by Indian citizens. Its ambit covers diverse entities and transactions, including foreign exchange, securities, export-import activities, securities defined under the Public Debt Act 1994, financial dealings, insurance, and overseas companies predominantly owned by Non-Resident Indians (NRIs) or Indian residents, both within the country and abroad.

Authorised Persons (APs) under FEMA:

- As defined in Section 2(c) of FEMA, ‘authorised person’ encompasses authorized dealers, money changers, offshore banking units, or individuals specifically authorized under Section 10(1) to engage in foreign exchange or foreign securities dealings. These entities hold RBI authorization to engage in such transactions, ensuring compliance with FEMA’s provisions.

Conclusion:

- FEMA, as an instrumental legislation, stands as the cornerstone for regulating foreign exchange transactions in India. Its multifaceted provisions and comprehensive scope ensure a structured and compliant ecosystem for external trade and payment facilitation, overseen by the Reserve Bank of India through its authorized entities.

Daily Gist : The Hindu/Indian Express : 30 Jan 2025

January 30, 2025

Gist of editorial : the Hindu/ Indian Express/20 Jan 2025

January 20, 2025

Daily the Hindu/ Indian Express Editorial Gist: 14 Jan 2025

January 14, 2025