December 3, 2023

Union Cabinet’s Approval of Sixteenth Finance Commission’s Terms of Reference

Introduction

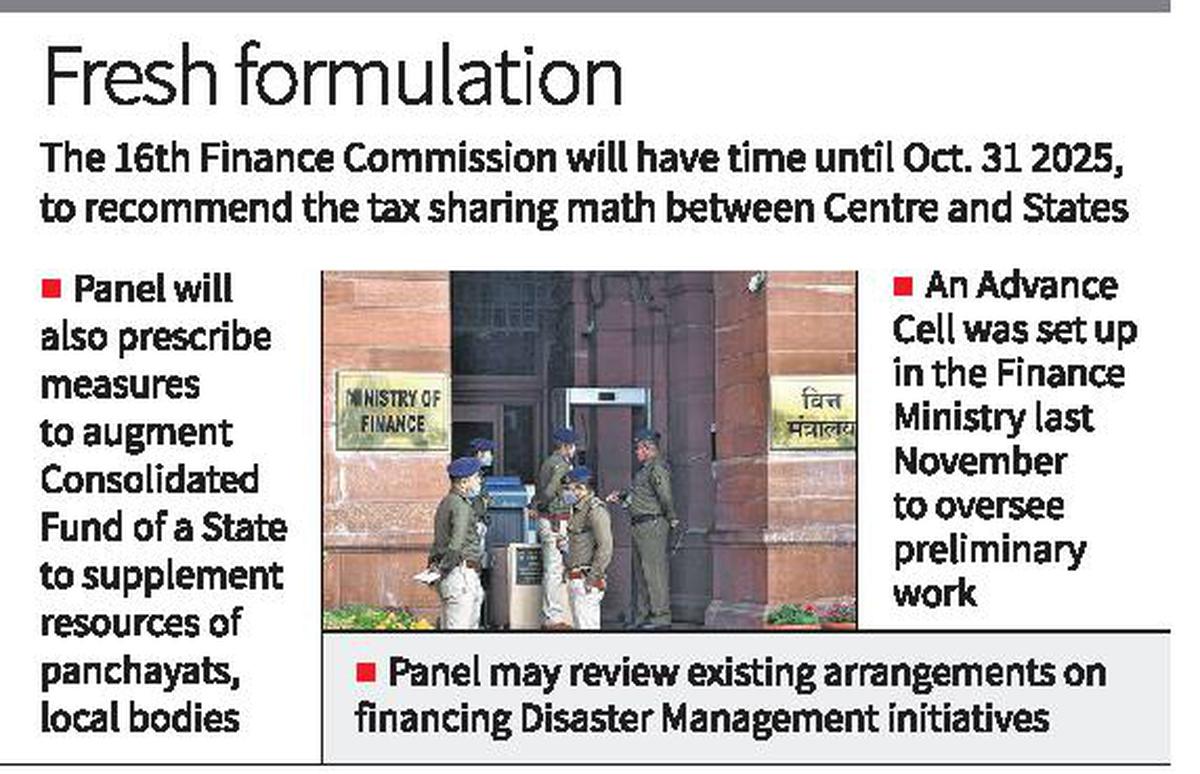

- The recent Union Cabinet approval marks a significant milestone in the progression of the Sixteenth Finance Commission. The Commission’s pivotal task revolves around formulating a comprehensive revenue-sharing formula between the Central government and the States. Commencing its operations from April 1, 2026, this pivotal period holds crucial implications for India’s fiscal landscape.

Unveiling the Finance Commission: A Historical Context

- The inception of the Finance Commission dates back to 1951, established by the President in accordance with Article 280 of the Indian Constitution. Delving deeper, its fundamental objective lies in delineating and overseeing the intricate financial relationships between the Central government and the distinct state governments.

Legally Framed Operations: Insights into Structure and Responsibilities

- Legislatively, the Finance Commission operates within the framework defined by the Finance Commission (Miscellaneous Provisions) Act, 1951. This act meticulously outlines the qualifications, appointment procedures, terms, powers, and eligibility criteria of the Commission. Constituted every five years, the Commission consists of a chairman and four other members.

Constitutional Anchors: Mandates and Key Functions

- Crucially, Article 280 of the Indian Constitution intricately defines the Commission’s composition, members’ qualifications, and their terms of reference. It tasks the Commission with recommending the distribution of net tax proceeds, allocation among States, and handling financial relationships between the Union and States, along with the devolution of unplanned revenue resources.

Navigating Key Responsibilities: Functions and Member Dynamics

- The pivotal functions of the Finance Commission encompass recommending the distribution of net tax proceeds between the Center and States, determining principles governing grants-in-aid to States, advising on strategies to enhance State Consolidated Funds, and addressing various financial matters referred by the President.

Member Dynamics and Challenges

- The Commission’s structure adheres to the Finance Commission (Miscellaneous Provisions) Act, 1951, laying down stringent criteria and global standards for its composition. The Chairman, chosen for their expertise in public affairs, leads a team comprising members with specialized expertise in judicial, administrative, and financial domains.

Challenges and Ongoing Recommendations

- A notable challenge faced by the Sixteenth Finance Commission lies in coexisting with the GST Council, raising concerns about potential conflicts of interest and feasibility of recommendations. Furthermore, some outstanding recommendations from previous commissions, such as the establishment of a Fiscal Council and a Non-Lapsable Fund for Internal Security, await implementation despite being acknowledged ‘in principle’ by the government.

- In conclusion, the Union Cabinet’s recent approval underscores the pivotal role of the Sixteenth Finance Commission, set to navigate intricate fiscal landscapes and shape the revenue-sharing paradigm between the Centre and States for the forthcoming years.

National Commission for Scheduled Tribes (NCST)

November 5, 2024

Dutch gravity canal system

November 5, 2024

हॉटस्पॉट तकनीक:HotSpot Technology

November 5, 2024